Editor’s Note: If you’re planning to bet on sports, you need to be getting the best line. That means having money on multiple books. Find the best signup bonus offers by state here.

Sports gambling has exploded across the United States. Before May 2018 — when the Supreme Court struck down PAPSA — Nevada was the only state with legal sports betting. Now, it’s legal in 37 states (although it hasn’t been launched in all of those states yet). In less than half a decade, sports betting has transformed from a taboo topic to a multi-billion-dollar industry in the United States. Ads for companies like DraftKings and FanDuel dominate commercial space during sporting events, and even the leagues themselves are cashing in with sportsbook partnership deals.

With the increased popularity of sports betting has come an uptick in both gambling content and gambling conversation. Much of that is constructive (or at least aims to be), working to educate consumers about an industry that has only recently become mainstream. However, some myths have made their way into the public sphere. Those myths can lead to people making poor bets because they misunderstand market dynamics. Today, we’ll dispel some of the most popular fallacies in the sports betting space.

PRICE DISCOVERY AND “VEGAS KNOWS”

Many recreational bettors out there believe the sportsbooks have hyper-advanced algorithms spitting out near-perfect numbers for every sports game, and that’s why it’s so hard to win long term at sports betting. They subscribe to the theory that books have large numbers of quants crunching the numbers and turning all available data for a game into a single number. Often, a game will land right on or next to its spread/total, and people will say that “Vegas knows.” However, that could not be further from the truth.

In fact, there are often lots of inefficient lines on sportsbooks, even on sides and totals. It’s just that most people aren’t betting early enough to see them (and most people, myself included for most markets, cannot identify which numbers are inefficient).

The process by which sportsbooks arrive at a certain number is referred to as “price discovery”. We’ll use the NFL as an example because it has a week-long price discovery process. Some books will actually post lines for games more than a week in advance (e.g., you can bet on Week 4 before Week 3 kicks off), but we’ll ignore those for the sake of simplicity in this example.

Sportsbooks will post NFL lines for the following week on Sunday night or Monday morning. They don’t have a legion of quants writing thousands of lines of code to arrive at these numbers. Instead, they have a relatively small number of statistically proficient traders. The bets start rolling in when they post a number, but limits are still pretty low at that point.

Say they post Chiefs -4 in a game against the Chargers. They immediately get one limit bet on each side. The first bet is on Chargers +4 from Customer A, a professional bettor who primarily focuses on the NFL. He’s shown a multi-year history of profit betting into markets like this one. The second bet is on Chiefs -4 from Customer B, who hit it big in the technology industry and retired young in Las Vegas because he loves the thrill of gambling. He’s had his hot streaks through the years, but his bet history shows that he’s a coin-flip lifetime bettor. Both customers wagered the same amount, but the sportsbook is going to move the line toward the Chargers because Customer A is tagged as a sharp player. In essence, the price discovery process involves sharp sports bettors selling their information to the sportsbook in exchange for expected value.

Limits increase throughout the week as the line moves toward efficiency and books stop getting sharp action on one side. Some sportsbooks won’t even post lines until a lot of price discovery has already happened and limits are already relatively high at market-making books. By the time most rec bettors look at lines in the middle of the week or later, they are already efficient, and that’s a big reason why so many casual gamblers struggle to hit more than 50%.

Note that the example above is a simple one. More factors go into it: Some sharp bettors don’t bet lines early in the week because they’d rather wait for increased liquidity, and they could even bet the opposite side as a head fake so they get a better number when limits go up. But in general, that is how sportsbooks arrive at their numbers. They aren’t an all-knowing entity that sets perfect lines every time; the bettors are the ones with the information and they bet the line into an efficient spot. Vegas doesn’t know; the market does.

BALANCED ACTION ON BOTH SIDES

A lot of bettors believe the goal of sportsbooks is to have 50% of the money on each side so they can collect the vigorish and call it a day. However, thinking about the impact of price discovery makes it clear why that cannot be the case for the overwhelming majority of games.

Say every sportsbook in the world is hanging Chiefs -3 vs. the Chargers. Suddenly, DraftKings starts getting some action on the Chiefs on Sunday morning. A couple of whale accounts — high-stakes bettors without an edge — think there’s no way Patrick Mahomes should only be a field goal favorite in a high-leverage divisional showdown. DraftKings now has outsized liability on the Chiefs, but if they move the line, they’re going to be slammed with sharp action on the Chargers. As a result, they stay with the 3-point spread and basically just gamble on the outcome. In the long run, price discovery ensures the book will come out ahead because they know their numbers are efficient. Former Jeopardy! champion and professional sports bettor James Holzhauer summed it up well in an article for The Athletic:

“A popular misconception is that sportsbooks set their lines in order to get an equal amount of money on each side. Aside from rare exceptions like the Super Bowl or 2017’s Mayweather-McGregor fight, public money is generally not enough of a factor to move the odds. The book typically prefers to keep the line close to the ‘correct’ number and gamble on the result, rather than move to an off-market number and attract a flood of action from advantage players.”

Holzhauer does point out that sometimes there are events so public that the sportsbook will move on public action. This is extremely rare, but if there is a public side that would be financially catastrophic for the books if it hits, they might move the line. In general, though, sportsbooks are not just trying to balance the action on both sides. They are, rather, trying to hang the most efficient number.

REVERSE LINE MOVEMENT

Reverse line movement focuses on the betting splits published by sportsbooks, comparing the percentage of bets to the amount of actual money wagered on each side. It theorizes that if a higher percentage of bets are on one side, but the majority of money is on the other side, then there is value in fading the public and rolling with the “sharp money”. There are many holes in this idea, so we’ll go one at a time.

First, RLM is most frequently referenced in relation to legal rec books like DraftKings or BetMGM. These books take low limits and don’t even set their own lines — they copy from market-makers like Pinnacle and Betcris — so they often move their lines based on what the sharp books are doing as opposed to action on their own site. In other words, if the sharpest books in the world move a line from -4 to -6, they don’t want to be the only book in the world hanging -4, so they move the spread despite no/small action on their site. That basically renders the betting splits irrelevant because the book themselves isn’t even moving off the action they’re getting.

Adjacently, betting splits can vary by book because they aren’t truly undergoing their own price discovery process. It’s not uncommon for FanDuel to have the majority of money on one side and DraftKings to have more money on the other side. Basically, I most commonly see reverse line movement referenced with rec books, but those are irrelevant because they aren’t undergoing natural price discovery and can have different splits from one another as a result.

That explains why the idea of RLM based on splits from rec books doesn’t fly. But what about books like Circa Sports or the aforementioned Pinnacle and Betcris?

Unfortunately, even if that information was always available, it still wouldn’t be useful because betting splits lack the context of when those bets were placed. Using the example from before, let’s say Circa has a spread of -4 for an NFL game. The sharps think the spread should be around 6 points, so Circa quickly gets a lot of money on the favorite and moves the line to -6. From there, the sharps ease off because the line seems pretty fair, and Circa continues to see recreational action the rest of the week on both sides. Maybe they even get more bets on the underdog due to just random variance of which side people are betting. They’re not moving off square action, so they remain at -6 when the game kicks off. In this example, there would be a fairly even number of bets on both sides with most of the money on the favorite, but -6 is still a terrible bet because the sharps got in at -4.

The lone exception — which is honestly more of a hypothetical than anything you’d actually see in practice — would be the betting splits from a market-making book on an event so public the line doesn’t move despite sharp money on one side. Maybe there will be a Super Bowl where the public is so overwhelmingly on one side that the sportsbook actually doesn’t move the number on sharp action on the other side, in which case betting splits from a sharp book would be relevant. Otherwise, betting splits and the idea of reverse line movement are completely meaningless and more likely to coerce you into -EV bets.

EXPECTED VALUE OF PARLAYS

Note: This section is not about same-game parlays, which are a beast of their own.

In Illinois in 2022, FanDuel held 23.8% on parlays. For reference, the hold on a bet that is -110 on each side is 4.55%. With most casual bettors donating on parlays, the rhetoric that parlays are awful bets has become relatively common. And for most bettors, that’s true! But it’s not because parlays are engineered by the sportsbooks to trick sports bettors out of profit.

WSJ wrote an entire story about how wretched parlays are for recreational bettors.

In Illinois in 2022, FanDuel held 23.8% on parlays and 5.1% on single-game bets. And 71% of all bets were parlays.

As more ppl blast into SGPs, the hold percentages get really high. pic.twitter.com/PtctGIm2nd

— Adam Levitan (@adamlevitan) May 9, 2023

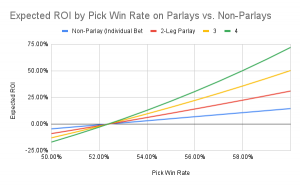

Rather, parlays are bad for most people because most people are losing sports bettors. Parlays don’t charge extra juice or anything sinister like that — they simply compound your edge, whether it’s positive or negative. For example, if you are a bettor with a 50% lifetime hit rate, your expected value on a -110 bet is -4.6%. If you pair two -110 legs together in a parlay, your edge is -9.0%. The breakeven percentage for a parlay and a straight bet is the exact same. The graph below demonstrates how parlays also compound a positive edge, making them a legitimate weapon for profitable bettors (especially if limits are an issue).

The decision to bet parlays or not requires a hard look in the mirror. If you’re a losing player, you should basically never bet parlays. But if you are a winning player, they are a useful tool for circumventing limits and maximizing your ROI.

It’s worth noting that parlays are suboptimal for maximizing bankroll growth if you are betting optimally using Kelly criterion. However, the majority of bettors aren’t using Kelly for numerous reasons (unable to exactly quantify edge, running into limits, etc.), in which case parlays are a viable option if you’re winning at an above-breakeven rate. They are a particularly good tool for prop bettors because limits are such an issue compared to larger markets. The book The Logic of Sports Betting — which is a must-read for any new bettor — explains how parlays allow you to get more money down:

Parlays are also usable in the rare scenario in which you can find correlation that isn’t priced in. Example: The Cubs and Cardinals recently played a two-game series in London. Totals for both games were much higher than usual because there was a Yankees-Red Sox series at the same stadium (with slightly shorter fences) in 2019 where 50 runs were scored across two games. This was an interesting case study because the 2023 stadium was only slightly smaller than the MLB average and the game was played at sea level, unlike the Mexico City series where any decently hit fly ball was a threat to leave the park. There were reports of less drag on the ball and bouncy turf that could have led to more runs. With so much uncertainty surrounding this game and a lack of information as to how it would play, parlaying the under in the first game with the under in the second game (or vice versa) was likely a +EV bet because we didn’t know how the stadium would play. DraftKings was allowing users to bet that parlay at standard juice, and the under did end up hitting in both games. Sportsbooks are usually on top of disallowing correlation in parlays, but there are sometimes edge cases in which things slip through the cracks.